Payroll taxes for employers can be, well, taxing. They’re a huge responsibility on employers, can’t be late, and they affect how much employers are able to pay employees. While not the only reason, payroll taxes make up the biggest reason why most employers choose a payroll provider or payroll software and don’t do it by themselves.

Check out this earlier post to get a broader understanding of payroll.

What Are Payroll Taxes?

Payroll taxes are money paid to the federal and state governments based on employees’ earnings. The official term for these taxes are FICA taxes, which stands for Federal Insurance Contributions Act. While FICA taxes make up the majority of tax deductions from paychecks, they are not the only ones that might come out of paychecks The history of that bill is closely intertwined with The New Deal and modern US history. The topic is worth a read when you have time, but today the focus is only the present.

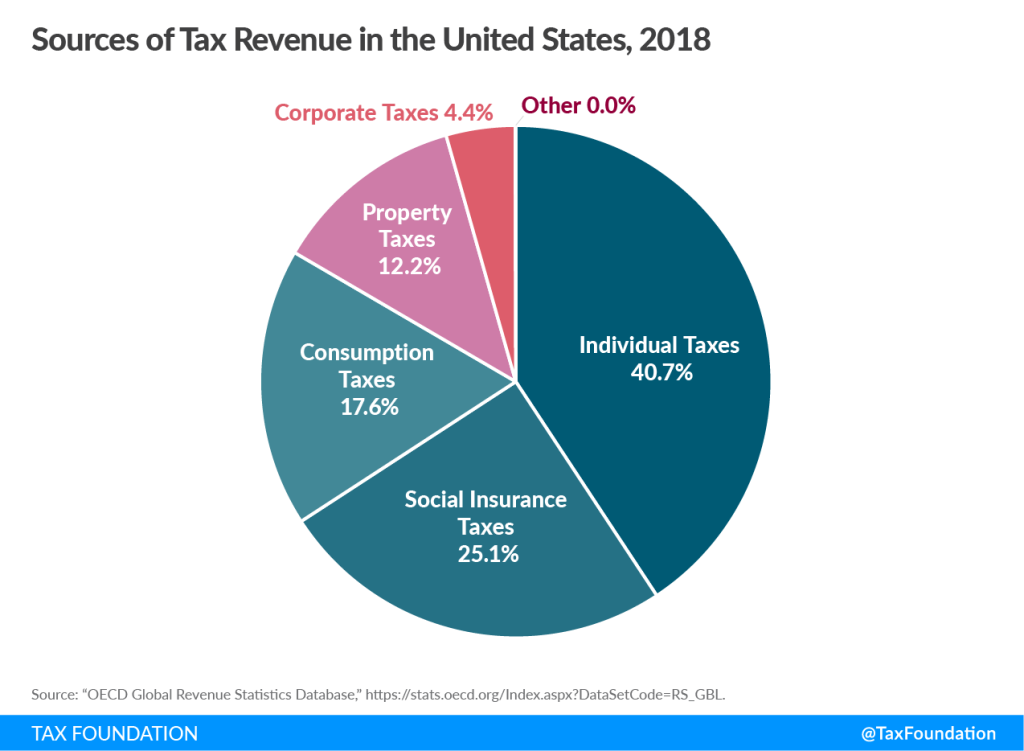

The image below shows the breakdown of federal revenue by category. Social Insurance Taxes refers to payroll taxes.

Are Deductions The Same Thing as Taxes?

No, deductions and taxes are a little bit different. All taxes are deductions, but not all deductions are taxes. Deductions might include other regulations that your state government requires deducted from paychecks. In other cases, there are employer-specific deductions that employees can opt into or out of. Lastly, courts can impose deductions on individuals’ pay as the result of a settlement.

This list shows all the possible deduction categories:

- FICA taxes

- Other state taxes

- Retirement savings & HSA contributions

- Wage garnishments

- Child support payments

Deduction Categories

FICA taxes make up the majority of most individuals’ personal tax burden, but their specific work and life situations determine what deductions come out of their pay.

State tax rates and deductions vary from state to state, but take New Jersey as an example. A worker making $30/hour for 40 hours per week would earn $1,200 pre-tax. After taxes, that person would take home $898. Of the $302 deducted, $44 would go to New Jersey, making the state payroll tax rate roughly 15% of the total. Check out your estimated payroll tax payment with this tool.

Employers might offer employees the option to create a retirement savings accounts. Other times, as in the case of New Jersey’s Secure Choice Savings Program, the law forces employers to offer employees a retirement program. Interested in the different types of retirement accounts and their benefits? Check out our articles on retirement planning for business owners and the different types of retirement account. Another type of account that employees might utilize is a HSA, a health savings account. This type of account allows people to save for medical expenses with their pre-tax earnings.

Wage garnishments can happen when a court ruling demands an individual’s earnings must go to another person or organization. Most often, the money gets redirected to the IRS or banks.

Lastly, child support payments are a specific type of wage garnishment that get their own category.

What Are These Taxes Used For?

The biggest portion of these taxes are used for social security and medicare. Medicaid makes up smaller portion. Many people refer to these programs, either lovingly or scornfully, as the “social safety net.” Some see these taxes as an important part of the American society. Others see them as wasteful, ill-considered programs. Regardless of where you fall on that spectrum, all employees and employers must follow the law and contribute

Do Employers or Employers Pay These Taxes?

While employers are responsible for giving the money to the government, both parties have to contribute their share. Each party pays 7.65%, adding up to 15.3% in total. Keep in mind that this doesn’t include additional taxes levied on high-earners, potential state and local income taxes, and specific state taxes like New Jersey’s FMLA and state unemployment.

The Tax Foundation is among those who argue that employees actually pay all payroll taxes. The argument suggests that employers consider how much they will pay on their employee’s behalf. They then simply deduct that amount from whatever they would have paid the individual. This gets deeper into economics and psychology, but it is often true that businesses pass on added expenses to their customers. It wouldn’t be a huge stretch to imagine they would also do the same for their employees.

When Do Employers Have to Pay?

Employers must hand over payroll taxes at the end of each quarter. The specifics? Employers must file Form 941 No later than March 31st, July 31st, October 31st, and January 31st. This page on the IRS gives the specifics dates and forms that most small businesses and self-employed must pay

Do Self-Employed Individuals Have to Pay Too?

Self-employed people don’t have to pay a payroll tax, but they do have to pay a self employment (SE) tax. This effectively charges them both employer and employee portions of the payroll tax. The SE tax is essentially unavoidable, regardless of what deductions or financial circumstances an individual finds themselves in.

Payroll Taxes for Employers are Here to Stay!

Payroll taxes make up a huge part of the federal revenue, so don’t expect them to go anywhere anytime soon. Hopefully, this gives you a better idea of where this money goes and why.